You can trade silver on the physical market by buying and selling silver bullion coins, bars and rounds. Many market participants and silver traders wonder what the best time to invest in silver is. Traders are comparing https://forex-world.net/ silver investments to gold investments, which is well known as a “safe haven”. This means that it is regarded as a relatively safe asset during tough times, such as during financial crises or recessions.

Silver mining companies may also be susceptible to uncontrollable forces that may move in opposite direction of silver. For example, imagine government invention that restricts the mining of silver. A silver mining company would be negatively impacted, while the price of silver would likely increase as there is now minimal change in supply and an increase in demand. Therefore, owning a silver mining company may not yield the same investment benefits as owning silver. Silver futures contracts are a form of derivatives that may or may not actually lead to ownership of any silver.

CFD and Forex Trading are leveraged products and your capital is at risk. Please ensure you fully understand the risks involved by reading our full risk warning. When you trade silver, you’ll be using derivative products to speculate on the underlying market price instead of taking ownership of bullion itself. There are multiple ways you can trade silver with us, including via futures, spot prices, stocks, and ETFs. Most silver trading takes place via futures, spot prices, shares and ETFs. As with all other asset classes, trading silver can be very profitable with the right risk and trade management practices in place.

Industrial Demand

Before the suspension of the gold/silver standard, when national currencies were backed by any of the two metals and the introduction of the fiat currency system, the ratio was more stable. It is worth learning more https://forexbox.info/ about Silver, in order to increase your trading advantage. We supply education materials at the highest level, and we hope that this in conjunction with our highly regulated structure affords you peace of mind.

The manufacturer may not be able to purchase the silver today because he doesn’t have the money, he has problems with secure storage or other reasons. Naturally, he is worried about the possible rise in silver prices in the next six months. He wants to protect against any future price rise and wants to lock the purchase price to around https://bigbostrade.com/ $10. The manufacturer can enter into a silver futures contract to solve some of his problems. The contract could be set to expire in six months and at that time guarantee the manufacturer the right to buy silver at $10.1 per ounce. Buying (taking the long position on) a futures contract allows him to lock-in the future price.

Futures Contracts

In fact, silver miners’ profits will rise faster than the price of silver, all else equal. Second, the miner can raise production over time, also increasing its profits. That’s an extra way to win with silver, over and above just betting on the price itself. Futures are risky, and they’re more suitable for sophisticated traders. You’ll usually need a large account balance to get started, too. The investment information provided in this table is for informational and general educational purposes only and should not be construed as investment or financial advice.

Remember Litecoin? The Silver to Bitcoin’s ‘Digital Gold’ Is Soaring – Yahoo Finance

Remember Litecoin? The Silver to Bitcoin’s ‘Digital Gold’ Is Soaring.

Posted: Fri, 30 Jun 2023 20:12:18 GMT [source]

Silver trading is the method of speculating on the price of silver in an attempt to profit by correctly predicting movements in its value. Investors have been trading precious metals for centuries, with silver being a prime example. Silver’s popularity as a traded metal was due to it being a reliable safeguard against economic downturns and inflation, and it also provides a variety of trading options. Fidelity offers additional ways to gain exposure to precious metals.

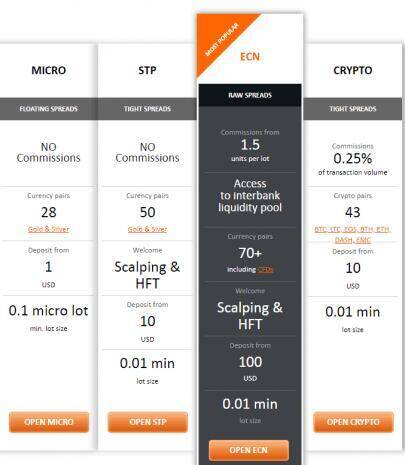

Trading platforms

A recession or slowdown in industrial demand would lower silver prices. Most traders (especially short term traders) usually aren’t concerned about delivery mechanisms. They square off their long/short positions in silver futures in time prior to expiry and benefit by cash settlement. The Comex Exchange offers a standard silver futures contract for trading in three variants classified by the number of troy ounces of silver (1 troy ounce is 31.1 grams). Precious metals such as silver have long been an alternative to traditional investments such as stocks and bonds.

The demand for it is therefore ever higher, while new deposits of this precious metal are rarely ever discovered. This only indicates that prices of silver more or less tend to rise in the long run. There are assets that investors seek for their ability to withstand market storms caused by economic or political crises.

A short History of Silver Trading

Whereas investing in an ETF represents an ownership that has a claim to silver, a futures contract may never be in-the-price, meaning you may never exercise the right to pay at a favorable price. For example, the United States Mint produces several silver bullion coins, with the most popular being the one-ounce American Eagle. Likewise, other coinage mints such as The Royal Canadian Mint also produce several silver bullion coins. However, these coins carry a similar premium when purchased directly from the mint. Third-party vendors also exist, but again, premiums to spot are prevalent.

- So you’ll be able to sell your funds at what’s likely the best price, and you can do so on any day the stock market is open.

- Silver can be a highly volatile market, creating opportunities to profit from price swings, but also presenting the risk of losses.

- Then, in late 70s, the commodities and futures commission (CFTC) announced that no individual would be allowed to own more than 3 million ounces of silver.

After you pass all the procedures and provide your personal information, you will be able to deposit funds and open your first trade in the silver market. To be trading efficiently , you should choose the right broker that will support you at every step and provide attractive trading conditions. If the above-mentioned reasons have convinced you to trade silver, check the steps you should take to open your first position.

The last few years have seen very high levels of volatility in silver prices, possibly pushing silver beyond the generally perceived limits for safe asset classes. In its simplest form, it is just two individuals agreeing on a future price of silver and promising to settle the trade on a set expiry date. To become a good silver trader, it is also important for you to understand the demand and supply dynamics. Most of the world’s silver is mined in countries like Mexico, China, Peru, and Australia.

- For a complete overview of all the silver instruments available to trade and their active time zones, view our product schedule.

- Using support and resistance levels helps range-bound traders identify the upper and lower ends of the trading range.

- We do not include the universe of companies or financial offers that may be available to you.

- The silver mine owner can benefit by selling (taking a short position on) the above-mentioned silver futures contract available today at $10.1.

Silver trading has grown in popularity over the last several decades, as speculators see silver as a way to hedge against currency loss, inflation, and geopolitical risks. If you want to diversify your portfolio, engaging in silver trading through the CFD market can be a fantastic option. Investing in silver is an effective way to speculate on interest rates, as silver is highly responsive to that market. Additionally, it is a precious and industrial metal, making it highly sensitive to global demand. Gaining expertise in silver trading can significantly broaden your portfolio and introduce a new source of potential profits to your trading.

Silver is a precious metal that has long been valued for its use in jewelry, mirrors, and as currency coinage. Today silver is also used in technologies like printed circuits, batteries, and other industrial products. One way to invest in silver is to buy bricks, jewelry, ingots, or commemorative coins made of this precious metal. Trading silver CFDs saves you the cost of paying for silver storage.

Instead, a futures contract (regardless of the underlying commodity) is the right to buy or sell a good at a future price. Instead of owning the commodity, you possess the right to trade it. During economic downturns or when a downturn is expected, many investors have taken comfort in owning precious metals. The risks of loss from investing in CFDs can be substantial and the value of your investments may fluctuate. 72% of retail client accounts lose money when trading CFDs, with this investment provider.